How to price your product or service

Your sales have to cover your personal and business expenses, plus give you enough extra money to make your effort worthwhile

When you get your first order for your product or service how much are you going to charge?. How are you going to make sure that you covered all your expenses plus make a profit on top?. It all depends whether it’s a product or service that you are offering.

Business Product

If you are selling a product that costs you eight euros to buy from China and two euros to have it shipped to you. You might think anything over ten euros is profit. However you need to consider the cost to send it to your customers, the time you spent in ordering, collecting, packaging, and posting it on. The costs of getting that first order, your website and advertising costs. There is also your internet connection, your electricity, heating, rent and petrol.

Business Service

If it’s a service you are offering, it’s a lot easier. There is just the materials to do the job and your time, but how are you going to price your time? To be able to calculate your time you first have to know how much you need to live on. This should be worked out on a personal finance sheet like below. For this example, will say it turned out to be 30 thousand per year. Then you need to know how long will the work take. So if you work 40 hours per week and it takes 10 hours to complete a single job, you can complete 4 jobs in a week. This would be 30k divided by 52 = 576 per week. Therefore 576 divided by 4= 144 per job.

Personal expenses

If you don’t know how much you need to live on, it’s time to gather all your household bills and draw up an expense sheet.

FREE download

Business expenses

When you are filling in the amounts on your business plan and first year cash flow. You will have to estimate all possible expenses that your Business may incur, in the first 12 months of trading. Get prices online or quotes over the telephone, as you only need to fill out approximate values at this stage.

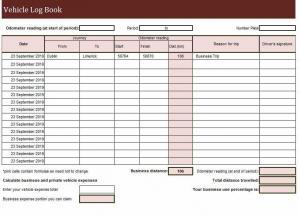

Your business expenses can sometimes overlap with your personal expenses. This occurs with anything you need for both personal and business use, your house, car and mobile are the most common. When this happens with your house you will have to assign a percentage. If you are working from home your electricity bill can be used as a business expense. You can use ‘area size’ or ‘working hours’ to calculate the amount. If my house has four rooms and I use one for an office, then 25% can be used. When calculating ‘Working hours’, there are 168 hours in a week if I work 40 hours then 23% can be used. When you are working out the percentage for your car. You can note your personal mileage and anything above that is for business use.

FREE download

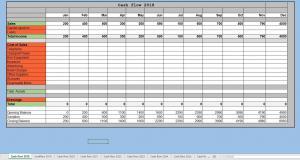

Cash flow

A cash flow is a monthly tally of what is in your business account. This ensures you have enough money to cover all your business costs. Fill out on a sheet like below showing when your bills are going to come out for telephone, internet, bank charges. You will need to do you expenses first. Where you don’t know the cost get a quote. Then you can estimate how many sales you need to cover your expenses and pay you a salary. This then will be your sales target that you have to achieve each month.

FREE download

FREE download

Price adjusting

Once you have completed your cash flow you can adjust your pricing. This will reduce your sales target. Bear in mind that there are many different pricing strategies used to achieve different ends. Most pricing strategies are employed by large companies to strangle competition. The vast majority of sole traders have no choice but to use the ‘going rate’ of a product or service. Remember, it’s better to make all your mistakes at this early stage. Working with Fictional money, rather than at the end of your first year of business.