Funding support

If you are looking for funding or support to get your business off the ground, there are many options. All involve you giving up some of your time. This could range from filling in application forms to taking part in training programs. These courses may have a selection processes to loans or grants at the end. So if your business venture needs a lot of initial work done, then they could work for you.

- Revenue schemes

- Social protection schemes

- Local enterprise office

- Enterprise Ireland

- Inter-trade Ireland

- NDRC

- Startup Boost

- Micro-finance Ireland

- Academies

- Angel investors

- Crowd funding

Revenue

The revenue offers incentives to Irish businesses and start-ups in the form of reducing your tax rates. They also allow you to claim previous year’s tax back in order to help you get started. Below is a list of reliefs and incentives.

- Startup Refunds for Entrepreneurs

- Start Your Own Business Relief

- The Employment and Investment Incentive for companies

- Research and Development

Start-up refunds for entrepreneurs

SURE is a tax relief that gives a refund of income tax that you paid in previous years. You can claim this if you are an employee, unemployed, or have recently been made redundant. The condition is that you are starting your own business. To meet these conditions you must:

- Create a new company with a new qualifying trading activity

- have Pay as You Earn income in the previous four years

- take up full-time employment in the new company as a director or an employee

- invest cash in the new company by purchasing new ordinary shares

- keep the purchased shares for four years.

Start your own business relief

If you have been unemployed for 12 months before you start the business. The Start your own Business Relief lets you to claim an Income Tax relief of up to €40,000 per year. You can claim this relief for two years. The scheme is valid from 25 October 2013 to 31 December 2018.

The employment & investment incentive for companies

For qualifying companies who wish to raise finance under this scheme. They must issue ordinary shares to the investor for the amount invested. The investor must hold on to the shares for four years. The company must use the money raised to carry on its qualifying trade.

If you start a new company, you can apply for tax relief for start-up companies. This tax relief is a reduction of your Corporation Tax for the first three years of trading.

You may be entitled to relief if your Corporation Tax due is €40,000 or less in a tax year. There could also be partial relief from €40,000 and €60,000.

Research & development grant

If your company spends money on research and development, it may qualify for this Tax Credit. The credit is calculated at 25% of qualifying expenditure.

Credit guarantee scheme

The state acts as guarantor to the bank for your business loan application.

https://dbei.gov.ie/en/Publications/SME-Credit-Guarantee-Scheme-Customer-FAQs.html

Social Protection

The back to work enterprise allowance

This scheme allows you to hold on to your social welfare payment while you setup your own business. It runs for a maximum of two years and is split into two schemes depending what social welfare payment you have.

Job seekers benefit: the scheme you are entitled to is the short term back to work enterprise allowance. This lasts as long as your benefit payment would last. That is a maximum of nine months.

Job seekers allowance: the scheme you are entitled to is the long term back to work enterprise allowance this will last two years. That’s 100% of your payment for the first year and 75% in the second year.

If you avail of these schemes a Enterprise support Grant can be applied for too. This is a grant for advertising, training or business equipment that you might need. There is up to two thousand four hundred euro available.

http://www.welfare.ie/en/Pages/Enterprise-Allowance-Self-Employed.aspx

Local enterprise boards

Who are they:

Local Enterprise have 31 dedicated teams across the Local Authority network.

Who it’s for:

- New business start-ups.

- If you are already in business and looking to expand.

What they offer:

- Advice

- Information

- Support

- Training

- Feasibility Study & Innovation Grant

- Refundable priming grant

- Trading Online Voucher Scheme of up to €2,500

- Business expansion grants

Feasibility study & Innovation grant

This is to investigate the viability of a new export business. It contributes to 50% of business costs and is capped at €15,000.

Refundable priming grant

- A business which on growth may be fit the Enterprise Ireland portfolio

- Employing up to 10 employees

- Manufacturing or internationally traded services business

Trading online voucher, up to €2,500 available

- No more than 10 employees

- Less than €2 million in turnover

- Be trading for at least 12 months

- Be located in the region of the local enterprise office where you are applying

Business expansion grants

- Located and operating within the LEO area

- Have a business which will have the capacity to progress to the Enterprise Ireland portfolio

- Your business is employing up to 10 employees

- Are a manufacturing or internationally traded service business

- Have a domestically traded service business with the potential to trade internationally.

https://www.localenterprise.ie

Enterprise Ireland

Enterprise Ireland

Who are they:

Enterprise Ireland is the government organization responsible for the development and growth of Irish enterprises in world markets.

Who it’s for:

- Irish owned businesses

- Internationally focused businesses

- Have the potential to employ at least 10 people within three to four years

- Your business has the potential to generate revenues of at least €1 million

What they offer:

- Innovation Voucher up to €5000

- New Frontiers Entrepreneurs development programme with the potential of up to €15,000 available if you proceed to phase two.

- The Competitive Start Fund This is up to €50,000 for a 10% equity stake

- CSF Graduate Entrepreneurship

- The Regional Enterprise Development Fund

- Investment Support and Pre-Investment Support

NDRC

NDRC

Who are they:

Funded by the Department of Communications, Climate Action and Environment and established in 2007.

Who it’s for:

- Digital companies

- Potential to grow internationally

What they offer:

- Investment of between €30,000 and €100,000

- 12 to 24 weeks working alongside start-ups, innovators and investors

- Mentor-ship in Company Financials and Investor Readiness, as well as Marketing, Design, PR and Business Model Innovation

- Weekly workshops and networking

- The opportunity to pitch to investors at the end of year

Intertrade Ireland

Intertrade Ireland

Who are they:

Inter Trade Ireland is a Cross-Border Trade and Business Development Body. They are funded by the Department of Business, Enterprise and Innovation in Ireland. They also have funding from the Department for the Economy in Northern Ireland.

Who it’s for:

- Manufacturing & Tradable Services Companies

- SMEs who have a good trading record

What they offer:

- Intelligence

- Funding

- Contacts

- The Seedcorn Competition

http://www.intertradeireland.com

Startup boost

Startup boost

Who are they:

They are a global tech start-up pre-accelerator programme.

Who it’s for:

They deal with early stage startups.

What they offer:

- A six-week part time program

- Local mentors

- Presentation training

- Investor introductions

Micro-finance Ireland

Who are they:

A not-for-profit lender established to deliver the Government’s Micro-enterprise Loan Fund.

Who it’s for:

Sole traders or small businesses who find it difficult to access finance.

What they offer:

They have loans from €2,000 up to €25,000. These are from 3 to 5 years.

http://www.microfinanceireland.ie/

Academies

Academies

Many universities and colleges offer mentoring, training and access to funding.

- DCU’s Ryan Academy http://ryanacademy.ie

- Rubicon rubiconcentre.ie

Angel investors

Angel investors

An angel investor is an affluent business person offering funding in exchange for ownership equity.

Crowd funding

Crowd funding

Crowd funding is an internet based way of raising finance for business. A commission fee is charged for their service.

- Kickstarter charge 5%commission for their service kickstarter.com/ireland

- Fundit have a 5% commission fundit.ie

- Icrowdfund charge 4% commission icrowdfund.ie

- Indiegogo have a commission of 9% with a refund of 5% if project goes ahead indiegogo.com

- Linkedfinance charge 5% commission www.linkedfinance.com

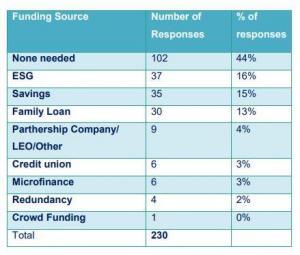

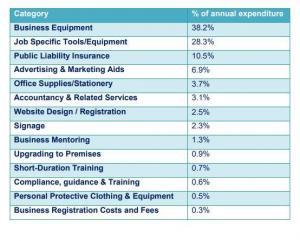

The Department of social protection carried out a review of the Back to work enterprise allowance scheme in February 2017. This scheme allows social protection clients to keep their payments for a maximum of 2 years while setting up their own business. Below are two charts where funding was needed and what it was used for.