How to easily keep your business accounts

Legally you have to keep a set of accounts for 6 years as a Sole trader but the manner which you keep your accounts is entirely up to you. You don’t need to be an accountant it’s best to keep them in the simplest way.

Business Income

Depending on your type of business your invoices can take many forms.

Till receipts

If you have a retail shop with a cash register at the end of your business day print out your till receipts this serves as monies received by customers.

Online business

If your customers pay by PayPal or similar payment methods than a statement from your account with them will suffice.

Cash business

A receipt book can be bought from any stationary shop such as Eason’s which has a receipt on top for your customer and a carbon copy for your records.

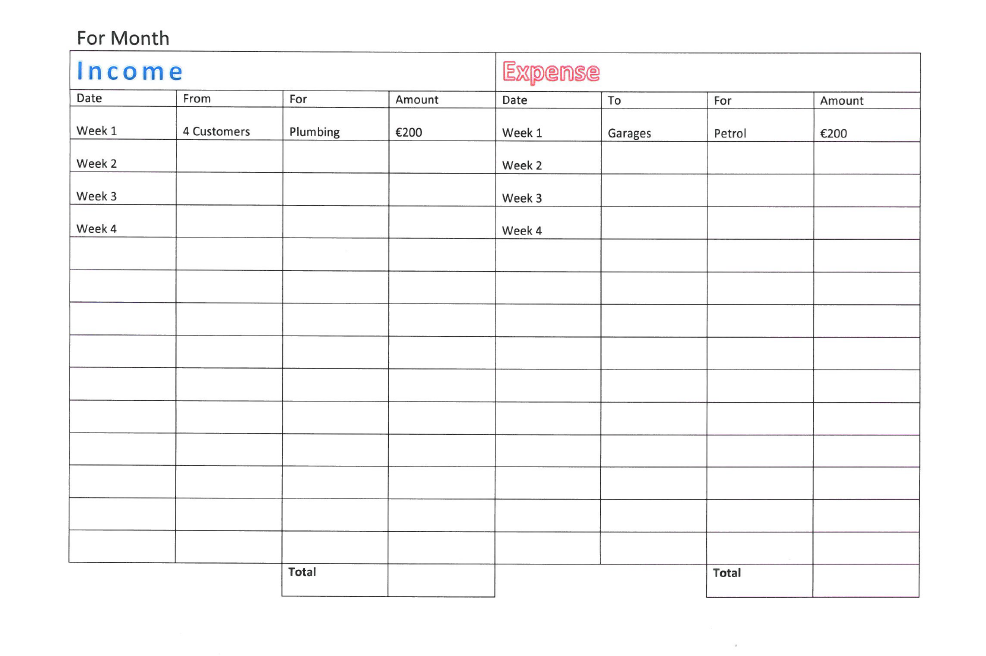

When you print an invoice for your customers put a copy of the invoice in an envelope and at the end of the month take them all out and record them on a sheet like below on the income side. Don’t worry about logging your invoices in order of date once they are within that month and year enter them in. Log as, Date Week 1, from 4 customers, for plumbing, amount €200 etc.

Business Expense

All money spent on your business needs to be recorded. So collect all shop receipts and keep them in one place (same envelope) at the end of the month gather all receipts and group them into categories, petrol receipts staple together and logged as one amount. on the Expenses side log as Date 30th, paid to garages, for petrol, amount €200 etc.

Staple your account sheet to your envelope with your invoices and receipts in and file away.

When you have 12 months (or 12 envelopes) that is your 1st financial year recorded. Bring your 12 months of records to an accountant with your Form 11 when you receive it. Remember your record of accounts will also provide the vital information you need to make sound decisions about your business.

FREE download

-

- Full accounts package without VAT

-

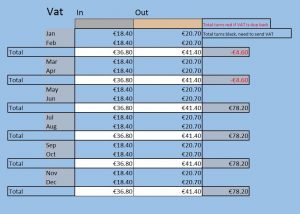

- With VAT for services

- With VAT for products