Taxation ‘the necessary evil’

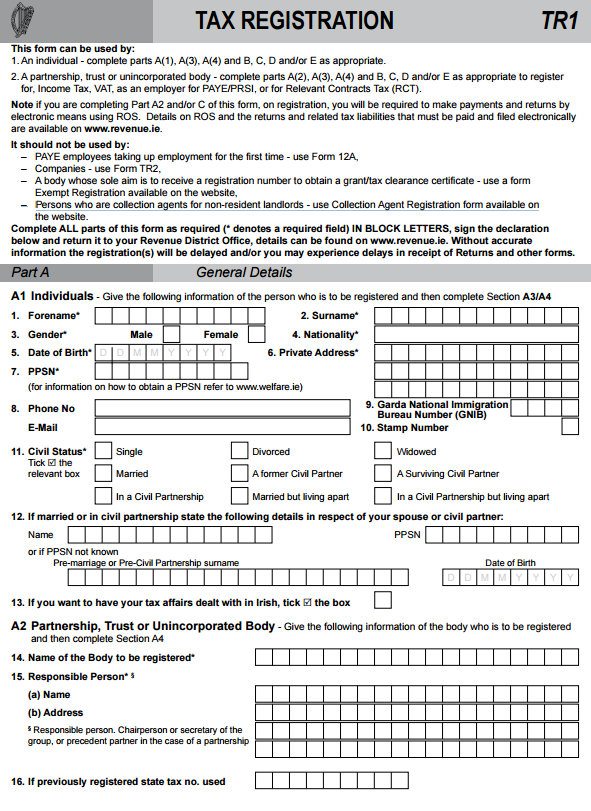

To register as a sole trader in Ireland all you need to do is download the Tax registration 1 (TR1) form fill out and send it into your local Revenue office.

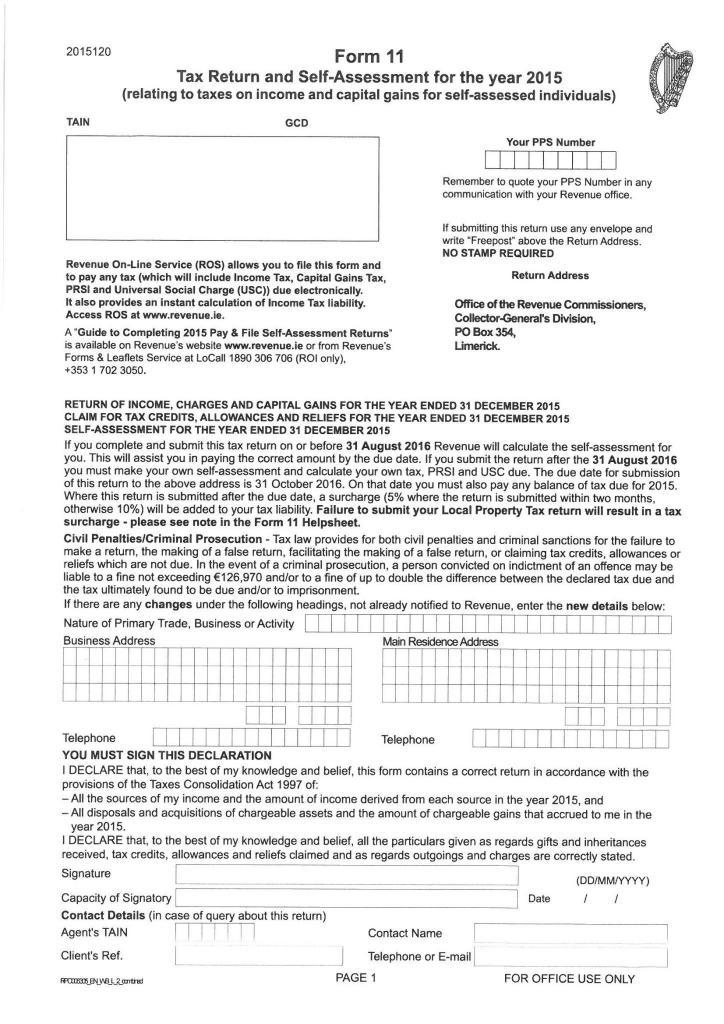

This puts you on a mailing list of sole traders in Ireland. Once a year a Self-assessment tax form (Form 11) is sent to your address for you to fill in and send back in to the ‘Office of the Revenue commissioners’. If you started your business in 2018 you don’t have to submit your tax return till Oct 31st 2019, this gives you ten months to make your return after that you’ll be subject to penalty fines.

Taxes are divided into the following:

VAT (Value Added Tax)

Income Tax

PRSI (Pay Related Social Insurance)

USC (Universal Social Charge)

VAT. Value added tax

You do not have to register for VAT if your gross profit is below €37,500 per year for supply of services or €75,000 per year for supply of goods. VAT is collected bimonthly you subtract VAT charged on your expenses from what you charged your customers, if you spent more on expenses you get a VAT return and if you charged your customers more than you send the VAT man the balance.

Income tax

The income tax computation is as follows

Total Business income, say €100k

(Minus) total business expenses, say €60k

equals your net profit, €40k

Standard tax rate 20% up to €35,300

Higher tax rate 40% on anything above this amount

So on a Net profit of €40K, €35,300 at 20%=€7,060

the remainder above €35,300 is €4,700 at 40%=€1,880

so total tax is €7,060 + €1,880= €8,940

PRSI. Pay related social insurance

This tax is mainly for your old age pension. You pay 4% of all your income or €500, whichever is greater. so on example above €40k at 4%=€1600

USC. Universal social charge

The Universal Social Charge (USC) is a tax that has replaced both the income levy and the health levy.

The rates are as follows

0.5% up to €12,012

2% Between €12,012.01 and €19,300

4.5% Between €19,300 and €70,000

8% Between €70,000 and €100,000

11% above €100,000

so on example above

0.5% of €12,012= €60.06

2%= €147.19

4.5%= €931.50

total is €60.06 + €147.19 + €931.50=€1,138.75

Tax total

Net profit €40K

Income Tax liability €8,940

PRSI €1,600

USC €1,138.75

Total tax payable=€11,678.75

Tax credits

The Irish tax system allows for Tax credits which is an allowance that you are not taxed on depending on your personal circumstance. Tax credits include martial status credits. Single person credit €1,650, married person credit €3,300 for a full list of credits visit http://www.revenue.ie/en/tax/it/leaflets/it1.html#section1

so if you are married your tax bill is €11,678.75 (minus married person’s tax credit €3,300)=€8,378.75 Amount paid to revenue

If you set aside 30% of your net profit you will have more than enough to pay your tax bill when make your tax return.

Updated to Budget 2019.

Total for Budget 2018 calculation was €11,487.07.

Difference of – €191.68 less in your pocket.